Wake Up 2 Wealth!

- Your complete guide to QROPS

(Qualifying Recognised Overseas

Pension Schemes)

QROPS Transfers

Australia, Belgium, Canada, France, Germany, Gibraltar, Ireland, Italy,

Malta, Philippines, Portugal, Spain, South Africa, Thailand, USA.

Wake Up 2 Wealth gives you all the information to establish whether you qualify for a QROPS.

If you do, we will introduce you to a specialist provider in the appropriate jurisdiction. Read on ....

Introduction ::

Reasons Why ::

QROPS Highlights

Leave Your Pension in the UK? ::

What To Do Next

Contact ::

Privacy

INTRODUCTION

Wake Up 2 Wealth supplies independent information on QROPS pension transfers (Qualifying Recognised

Overseas Pension Schemes).

Many varieties of QROPS exist all over the world, each offering different structures and solutions.

Here we present the facts simply and guide you to the QROPS solution most suitable for YOU.

REASONS WHY

Reasons you may wish to transfer your UK pension(s) to a Qualifying Recognised Overseas Pension Scheme include :

1. To ensure that your pension pot can pass 100% to your spouse or other beneficiary.

2. To enjoy the flexibility of controlling your own pension(s).

3. To invest your money freely as you choose.

4. To increase fund growth opportunities (accumulate more money)!

5. To unlock tax free cash.

6. To free your pension(s) from the ever-increasing risk of erosion of value if left in your current UK based scheme(s).

7. To benefit from a more tax friendly regime.

8. To offset changes to tax relief (the Budget (2012) and ongoing legislation which continues to threaten the value of UK pensions.

QROPS

Legislation introduced in April 2006 made it possible for British expats to transfer

their UK pensions to QROPS with the approval of HMRC.

This means that you can take your UK pensions abroad with

you when moving overseas or if leaving the UK on a long term basis.

Main points re. QROPS include :

First off, note that you must reach age 55 before starting to draw benefit but after that -

1. A QROPS doesn't die with you! It passes 100% to your spouse or other beneficiary.

2. QROPS are more flexible :

* More Investment Options

* More Draw-Down Options

* 100% After Death Benefits

Specifically -

* QROPS offer higher growth potential.

* QROPS offer higher income potential.

* QROPS can offer substantial tax advantages

* QROPS give greater investment freedom.

* QROPS may pay a larger lump sum at retirement.

* Most UK pensions can be transferred to QROPS.

* Transfers can include Protected Rights funds.

* Transfers can include pensions already in draw-down (from a Self-Invested Personal Pension Scheme for example)

but not where an annuity has already been purchased.

* Most QROPS are not taxed at source whereas UK pensions are. This creates the possibilty of tax savings.

And by the way ..... You cannot transfer a

State Pension!

LEAVE YOUR PENSION(S) IN THE UK?

Well there will be individuals for whom that is the best advice, leave it/them where they are. That is why it is

essential to talk to a professional specialist. To have a qualified consultant contact you,

Please Click Here.

But ....

** UK pensions have experienced poor fund growth and generally have lost substantial value during the financial

crisis.

** Large shortfalls have been reported by many UK pension providers which could lead to deteriorating

payments and conditions in years to come. With QROPS YOU control your money and the investments.

** By retiring abroad but leaving your pension in the UK you could leave yourself liable to tax on the pension,

potentially as high as 80%!

** And many UK pensions die with you ie. there is no benefit passes on to surviving spouse or family.

QROPS on the other hand are heritable, you can leave your entire pension fund to your chosen beneficiaries.

** A UK pension offers little or no control over the investments within the fund. With a QROPS you can

decide on the

investments and pick investments more appropriate to your own individual circumstance and preference. This can mean

higher growth potential and a bigger pension pot!

WHAT TO DO

So when considering a QROPS transfer it's essential to seek advice from a pension specialist.

They'll know which QROPS from the many available have the confidence of the industry and of investors

as being reputable and secure ... but ...

QROPS come in many forms and there is not a single solution suitable to all. The QROPS must be the right one for

YOU!

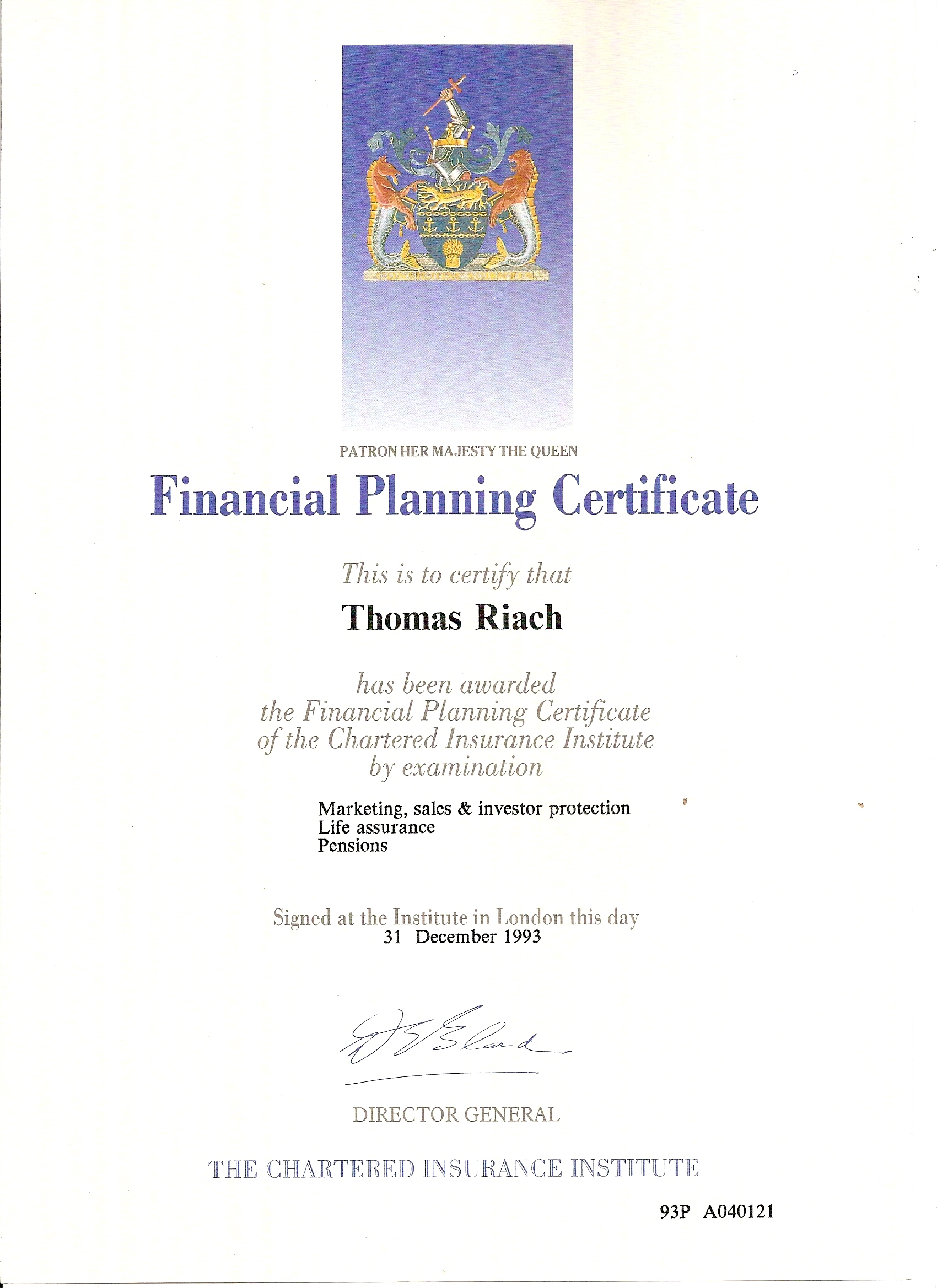

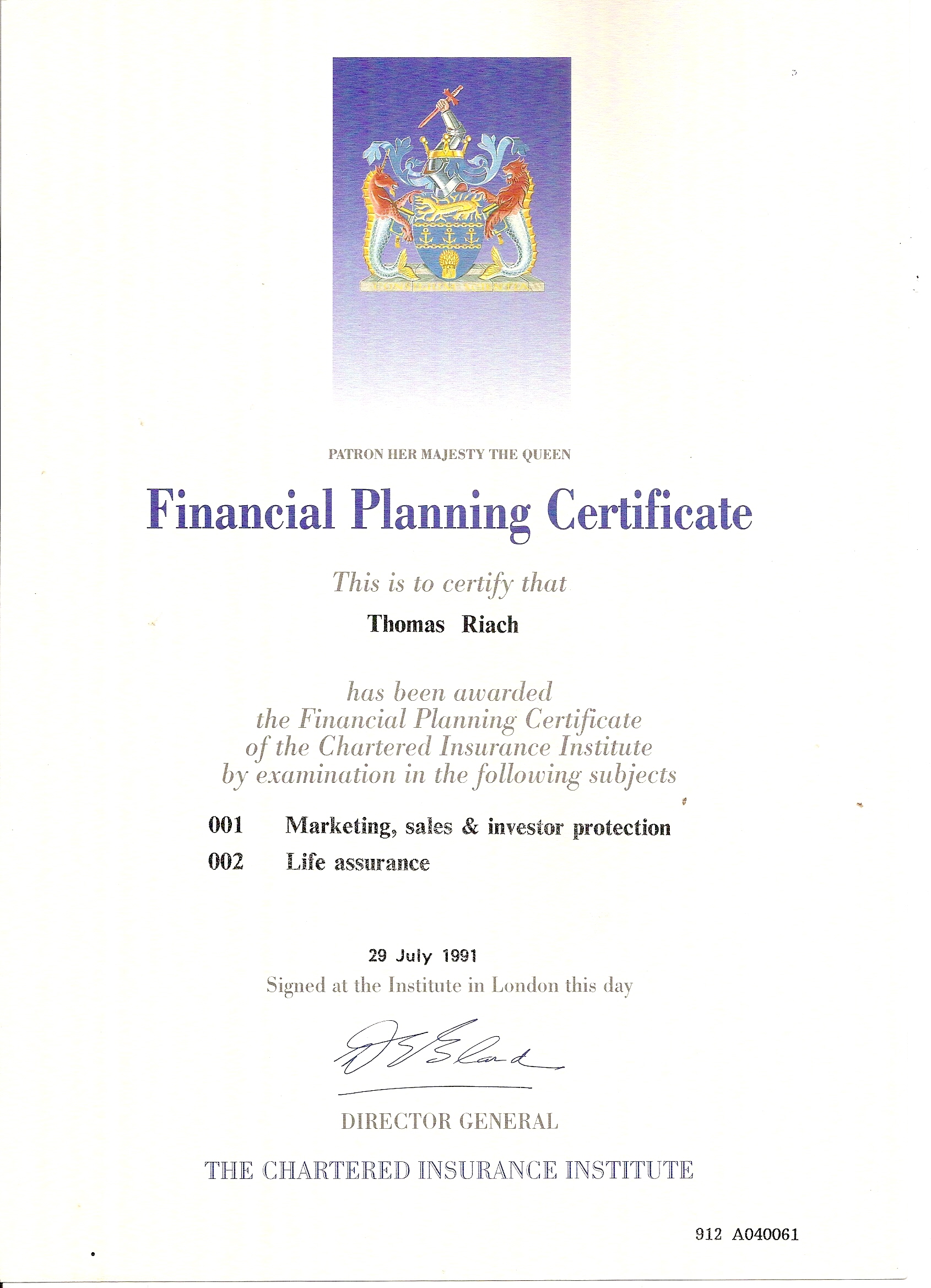

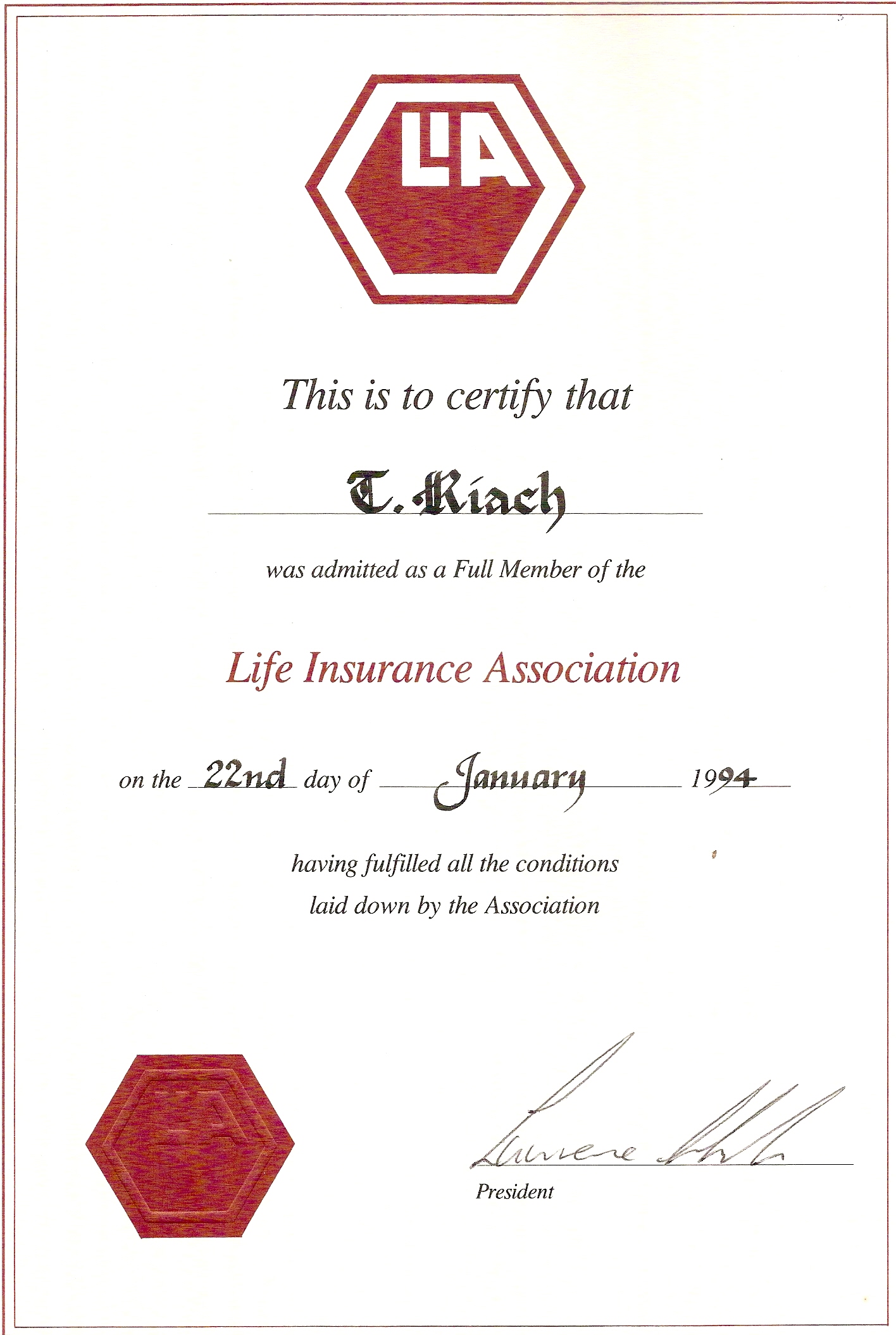

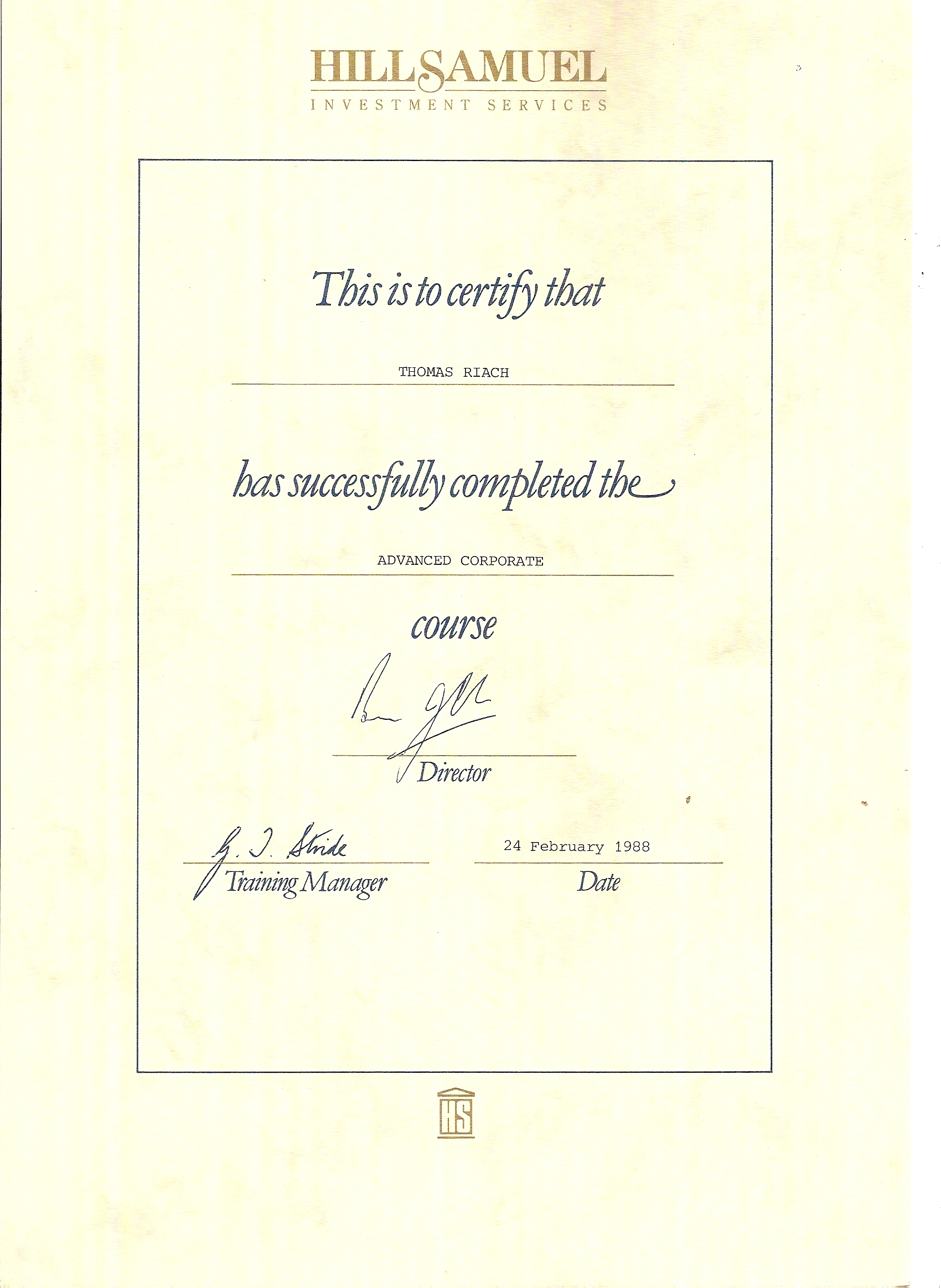

CONTACT

So contact us today to arrange a FREE no obligation consultation.

Please complete all sections of the FORM BELOW.

Give as much information as possible to allow us to properly appraise your situation and arrange for your

confidential consultation with a qualified specialist in your area, country.

Please note our Privacy Policy/Disclaimer.

Thank You.

Privacy Policy

Wake Up 2 Wealth are

committed to your privacy. Information collected on this site is used only to contact

enquirers in order to provide them with the information they requested. To alter

or delete this information, please contact us. We do not sell, share, publish nor rent this information to others.

Disclamer

While every care is taken to ensure that information on this site is accurate and up to date, we cannot accept

any liability for error or omission with regards to the content of the site. Wake Up 2 Wealth cannot be held liable

for any tax payable by the policy holder or others, now or in the future that may arise from a pension transfer,

whether it be tax in the UK or elsewhere. The aim

of this website is only to offer visitors information concerning QROPS and pension transfers and its content should not

be seen as financial, tax or investment advice. Wake Up 2 Wealth is an information only service, we do not provide

financial or tax advice. Information on this website should not be seen as a solicitation in any respect

to enter into any arrangement. Wake Up 2 Wealth acts as an introducer of business to

Joseph T.Riach in Portugal and to

other specialist pension transfer

companies and investment companies in other countries. We do not offer advice regarding any

products.

Your complete guide to QROPS (Qualifying Recognised Overseas

Pension Schemes)

Wake Up 2 Wealth